Frequently-asked questions (FAQs)

If you would prefer to download a copy of the FAQs, click here for the PDF.

Thanks for choosing Peak Super for your Self-Managed Super Fund. We’ve put together this list of 15 of the most frequently asked questions regarding SMSFs. Of course, you may have other questions so please don’t hesitate to contact us here if you would like more information.

What is a SMSF?

A self-managed super fund is a superannuation trust structure that provides benefits to its members upon retirement. They are a private superannuation fund that is regulated by the Australian Taxation Office. The difference between a SMSF and other super funds is that the SMSF members are also the trustees of the fund. All members are responsible for the decisions and compliance of the fund and its relevant laws and regulations.

What are the advantages of a SMSF?

An SMSF provides the trustees with more control over their financial future. The trustee(s) can decide how their fund is managed, control where their money is invested and have greater visibility over their retirement savings.

There a number of key benefits to having your own SMSF:

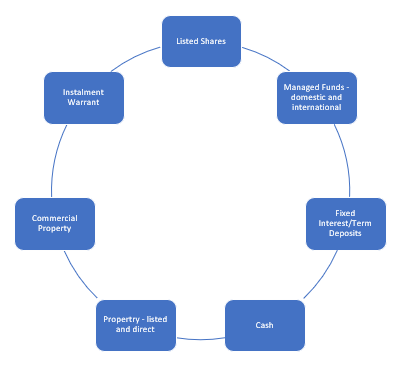

Investment Choice

Tax strategies

When in accumulation phase the fund tax rate is capped at 15% whilst in retirement phase, the tax rate can be as little as 0% for any income the fund derives. Tax strategies can help trustees grow their super savings and reduce tax liabilities as they transition to retirement.

Flexibility

You can have several members and run a mix of both accumulation and pension accounts. Trustees can make changes quickly when the market changes, change in personal circumstances or super rule changes.

Transparency

Trustees are able to align their personal goals with their investment decisions. Depending on your interest or what works best for your personal circumstances SMSF’s allow you to understand where your money is invested and also allows complete visibility to follow the overall performance and tax obligations.

Cost

Our fees are not based on how many assets you hold but will be determined on the investments held in the fund and any additional costs that may be involved with maintaining those assets. Fees are paid on a monthly basis and include preparation of financial statements and tax return, lodgement of tax return and audit fees.

How long does it take to set up a new SMSF?

We can arrange your superannuation fund trust deed and other statutory paperwork as soon as you request it. The ATO, as regulator, commits to a 28 day turnaround for new fund application approvals and once this is confirmed, your newly established SMSF is ready for receiving contributions and rollovers.

Can I be the only member in my SMSF?

Yes, you can have a single member in a SMSF. There are two options in creating a single member SMSF.

- Corporate Trustee: This can be established to act as the trustee of the fund in which the single member is the sole Director of the company.

- Individual Trustee: There is a requirement that there are two trustees but one can be a trustee that is not appointed as a member of the fund.

Am I eligible to make contributions?

The following table summarises the age limits and contribution types a self-managed fund can receive:

| Members Age | Personal Contributions made by Member | Other Contributions – someone other than member or employee | Voluntary employer contributions | Mandated Employer contributions |

| Eg personal non-concessional, personal concessional contributions | Eg spouse contribution | Eg salary sacrifice, other employer contributions in excess of SG | Eg 9.5% SG, or contribution under industrial award | |

| Under 65 | Yes | Yes | Yes | Yes |

| 65 to 69 | Work Test | Work Test | Work Test | Yes |

| 70-74 | Work Test | No | Work Test | Yes |

| 75 and over | No | No | No | Yes |

What are the contribution caps?

There are limits imposed on the amount of contributions superannuation members can make on an annual basis. From 1st July 2017 the concessional contribution limit is $25,000 whilst the non-concessional contribution limit is $100,000. The non-concessional contribution cap still has a bring forward allowance which is now $300,000 for eligible members.

If you exceed your concessional or non-concessional contribution cap, the excess may need to be withdrawn from the fund. If left in the fund, the excess can be taxed higher than the 15% concessional rate.

Below is a table outlining the non-concessional caps with regard to your Total Superannuation Balance:

| Total Superannuation Balance | Contribution and bring forward available |

| Less than $1.4 million | Access to $300,00 cap (over 3 years) |

| Greater than or equal to $1.4 million and less than $1.5 million | Access to $200,00 cap (over 2 years) |

| Greater than or equal to $1.5 million and less than $1.6 million | Access to $100,00 cap (no bring forward period, general non-concessional contribution cap applies) |

| Greater than or equal to $1.6 million | NIL |

What can I contribute into my SMSF?

Cash is the most common form of contribution – either by way of the mandatory 9.5% employer payments, salary sacrifice or personal contributions. Members can also contribute assets directly into the super fund known as ‘in specie contributions’.

Such assets include ASX listed securities, widely held managed funds, business real property and bonds or debentures. You may need to consider potential CGT and stamp duty implications when transferring assets other than cash into your SMSF.

What is the difference between concessional and non-concessional?

Concessional contributions are made into your super fund by you or your employer, that a tax deduction can be claimed for including:

- Employer Contributions

- Compulsory employer contributions

- Salary sacrifice payments made to your super fund

- Personal contributions to super in which the taxpayer wishes to claim a personal tax deduction for

Concessional contributions are taxed on their way into the fund at 15%.

Non-concessional contributions are made to your super fund that you are not claiming a tax deduction for. Non-concessional contributions do not incur tax entering the fund and can be a great way to save for retirement, as long as you understand the preservation rules.

As of 1 July 2017 if you have a balance equal to or greater than $1.6 million, your non concessional contributions for that year will be nil. See ‘What is the Transfer Balance Cap’ below.

Why do you do monthly reconciliations?

We reconcile your super fund bank accounts monthly for the following reasons:

- Expedite end of year account processing;

- Raise queries with you in a timely manner;

- Provide your advisor with up to date reporting as needed;

- Minimise compliance risk with the SIS Act;

- Remind you to meet your minimum pension (if applicable); and

- Review your contribution history

What are Bank Authority Forms?

Bank authority forms allow us to receive a data feed directly into our SMSF software from your banking institution. The authority is limited to a ‘view only’ feed, which means we do not have access to transact on your account. Having this authority allows us to reconcile your fund each month without the need to request copies of your bank statements.

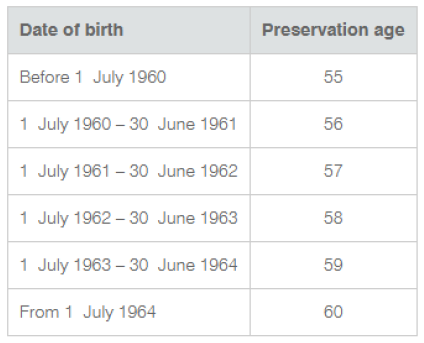

What is preservation age?

Preservation is a restriction on members from accessing their superannuation entitlements. Preservation age is a key age the member attains when they may have a restriction removed. For members born before 1 July 1960, this age was 55. See the table below to confirm when your preservation age is met. Once you have attained preservation age you may be eligible to commence an income stream from your fund.

How is my total super balance calculated?

Total Superannuation Balance is a new term post the November 2016 superannuation reforms that is used to determine your eligibility for a number of contribution types and eligibility to claim ECPI deductions.

Your total Superannuation Balance is the sum of:

- Your accumulation phase superannuation interests

- The balance of your transfer balance cap (if you have retirement phase superannuation interests)

- Any amount in rollover transit between funds

Less

- Personal injury or structured settlement payments that have been paid in to your superfund(s)

What is the Transfer Balance Cap?

The Transfer Balance Cap is the limit that can be transferred into the retirement phase of superannuation. The cap applies from 1 July 2017 and will include any retirement phase assets in existence or commenced on or after this date.

The transfer balance cap will start at $1.6 million and then be indexed periodically in $100,000 increments in line with CPI. Indexation will be calculated proportionally based on the amount of your available cap space. If your cap is met or exceeded at any time you will not be entitled to indexation.

The following transactions will cause a credit or debit to your transfer balance cap:

| Transfer Balance Credit | Transfer Balance Debit |

| Value of all retirement phase income streams at 30 June 2017 | Commutations |

| Value of retirement phase income streams commenced from 1 July 2017 | Structured settlement contributions |

| Value of reversionary pensions | Certain events resulting in a reduction in a super interest – fraud, dishonesty and void transactions |

| Excess transfer balance earnings that accrue on any excess transfer balance amount | Payment split upon divorce or relationship breakdown |

| Payments in respect of a LRBA which increases the value of retirement phase interests | Failure to comply with pension standards |

| Failure to comply with a commutation authority | |

| Non-commutable excess transfer balance |

Please note that any subsequent earnings growth or loss does not apply to the transfer balance cap.